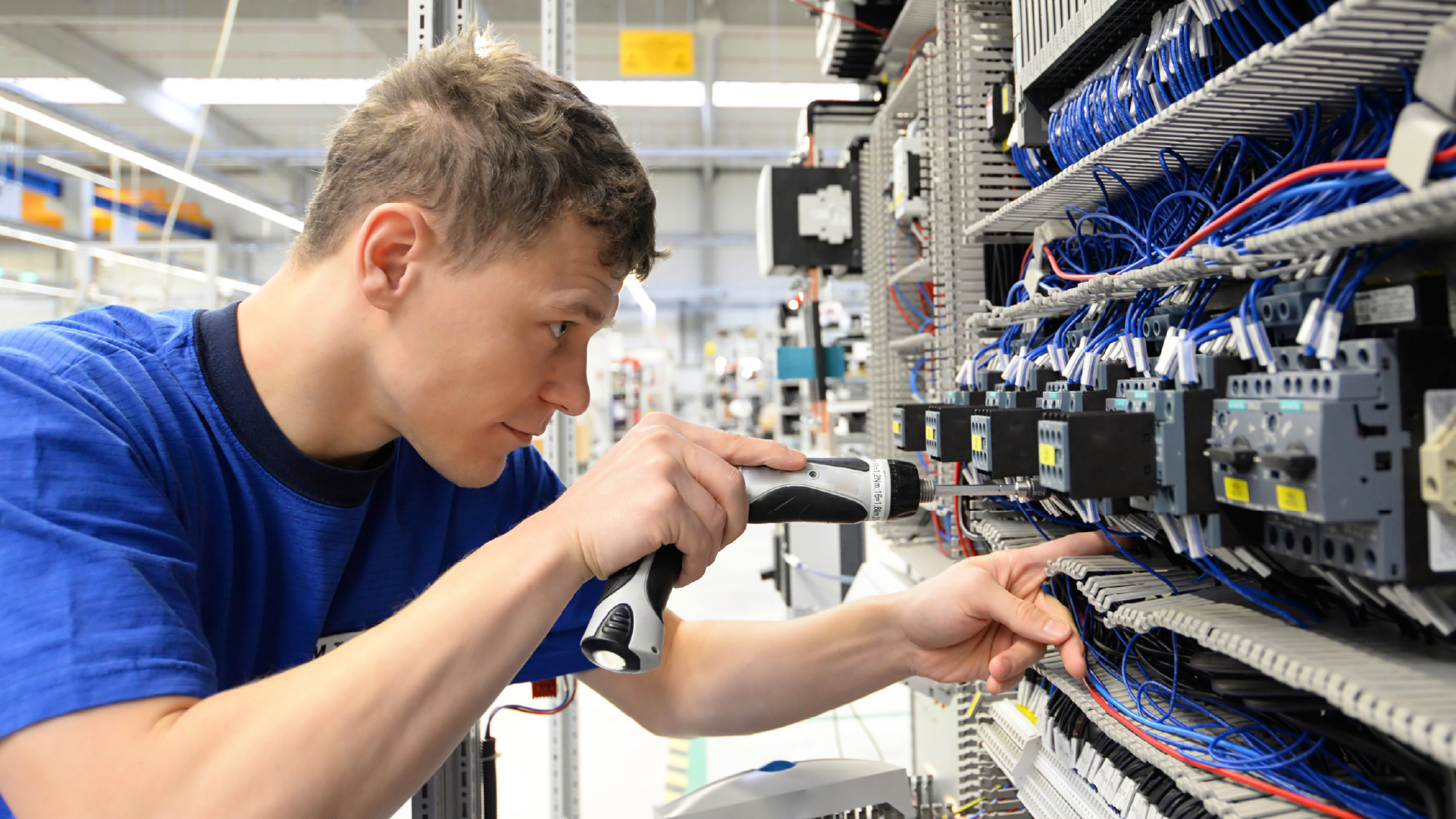

We Champion Opportunity

Earning a credential, certificate, or degree has the power to transform a person’s life. It can lead to financial stability, a fulfilling career, and a stronger community. Ascendium works to create opportunities for learners from low-income backgrounds to achieve that transformation.

Our Approach

We help people experience the transformative power of education and training beyond high school through four distinct functions.

Our Mission in Action

News